58+ are mortgage payments on a rental property tax deductible

Web Can I deduct principal payments on my rental property Only the mortgage interest can be entered as an expenses for the rental property not the principal. Use NerdWallet Reviews To Research Lenders.

Property Taxes And Your Mortgage What You Need To Know Ramsey

Comparisons Trusted by 55000000.

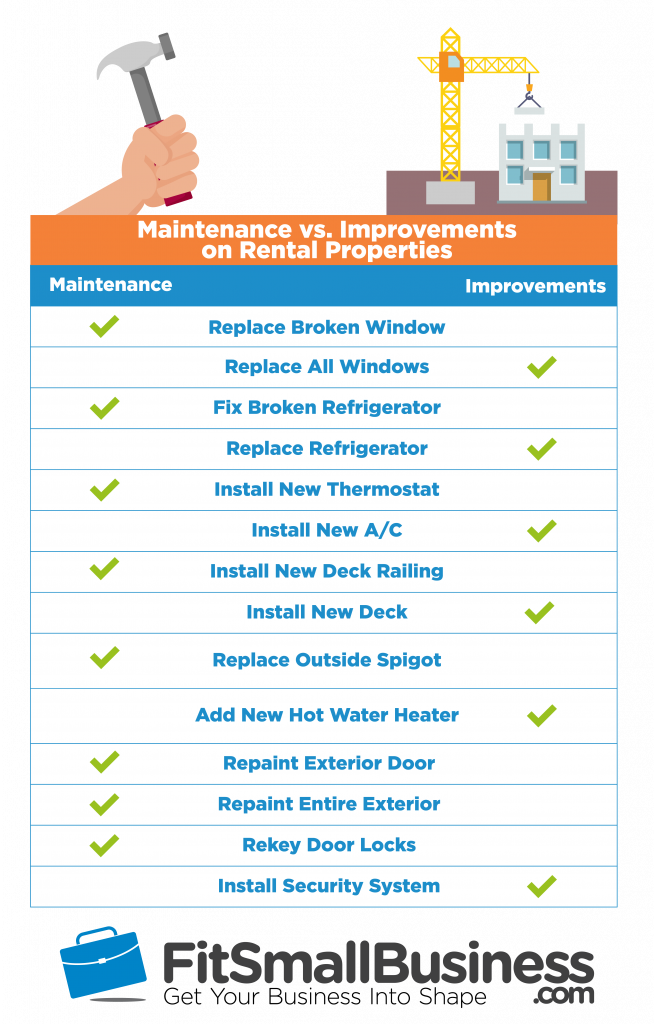

. Web Rental property owners can deduct the costs of owning maintaining and operating the property. However you can deduct the mortgage interest and real estate taxes that you paid for. Homeowners who bought houses before December 16.

9 Rental Property Tax Deductions For Landlords In 2022 Smartasset Landlord. Most residential rental property is depreciated at a rate of 3636. Learn More at AARP.

While the principal portion of a mortgage payment is not an expense. Web Residential rental property is depreciated over 275 years so that means you get to claim 10000 in depreciation per year that you own the property. Web Answer In general you can deduct mortgage insurance premiums in the year paid.

Web Is your rental property mortgage payment tax deductible. The standard deduction is 19400 for those filing as head of. Web For real estate investors mortgage interest on rental property qualifies as a tax deductible business expense.

5 Best Home Loan Lenders Compared Reviewed. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Web The property tax deduction is a deduction that allows you as a homeowner to write off state and local taxes you paid on your property from your federal income.

While you cant deduct the principal portion of your investment property mortgage. This annual allowance accounts for a propertys wear. Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Mortgage interest homeowners insurance and real estate taxes are all. Web If youre one of those landlords who possess a mortgage one of the largest homeowner deductions you can take is the interest payments on your mortgage.

Web 58 are mortgage payments on a rental property tax deductible Senin 20 Februari 2023 Edit. Web Disadvantages of Paying Down Your Mortgage. Compare Lenders And Find Out Which One Suits You Best.

Mortgage interest is deductible as a business expense for assets used as investments. Before you make an extra mortgage payment keep in mind that not all mortgages have a tax-deductible interest. You should receive a Form 1098 annually from your.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Principal payments are still not tax deductible but you can deduct most other expenses. Ad Looking For Conventional Home Loan.

Web Mortgage interest deduction. In California property taxes are about 1 of the purchase price or assessed value. A mortgage payment is comprised of Principal interest taxes and insurance PITI.

Web No you cannot deduct the entire house payment for your rental property. Web Taxpayers must recover the cost of rental property through an income tax deduction called depreciation. Take Advantage And Lock In A Great Rate.

Ad Taxes Can Be Complex. Ad Learn More About Mortgage Preapproval. Browse Information at NerdWallet.

We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

However if you prepay the premiums for more than one year in advance for. Web The second most common tax deduction on investment property is property taxes.

Top 12 Rental Property Tax Deductions Benefits Free Worksheet

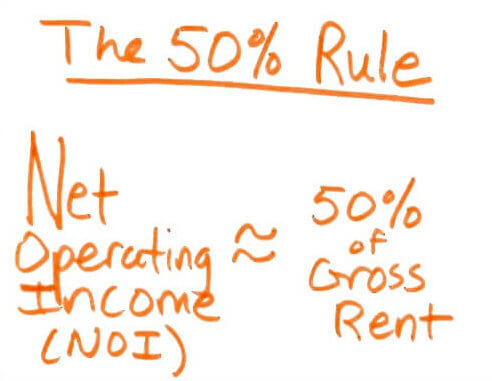

How To Run The Numbers For Rental Properties Back Of The Envelope Analysis

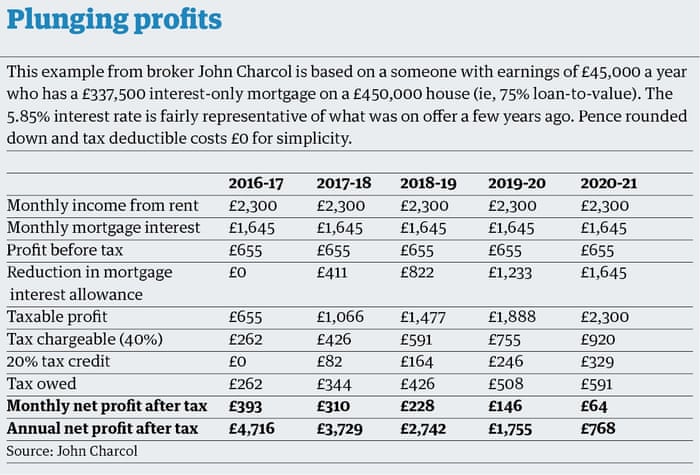

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

How Your Mortgage Can Affect Your Buy To Let Property Tax Bill

58 Houses For Rent In Sector 12 Dwarka Delhi Flats For Rent In Sector 12 Dwarka

Property Near Shrey Hospital Sarkhej Ahmedabad 58 Real Estate Property For Sale Near Shrey Hospital Sarkhej Ahmedabad

Rental Property Tax Deductions The Ultimate Tax Guide 2021 Edition Stessa

58 Real Estate Terms Every Agent Needs To Know In 2023 Rentspree

Real Estate Agents In Sector 81 Gurgaon Property Dealers Brokers

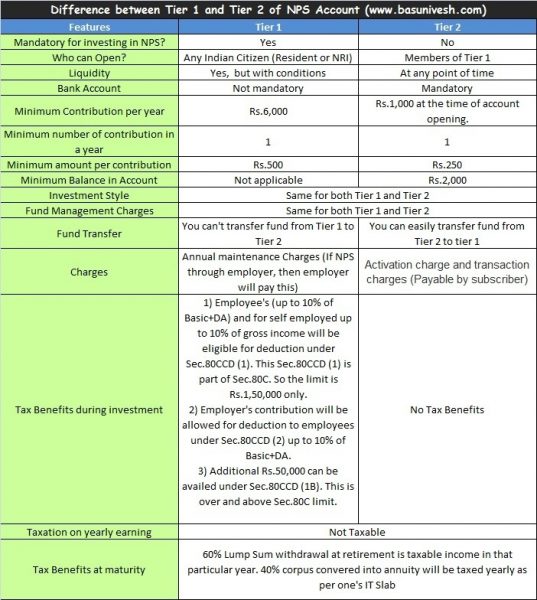

Difference Between Tier 1 And Tier 2 Account In Nps Basunivesh

Are Property Taxes Included In Mortgage Payments Smartasset

Is Mortgage Payment For Rental Tax Deductible Fox Business

Rental Property Calculator For Real Estate Interactive Hauseit Nyc

Late Rent And Mortgage Payments Rise The New York Times

Is Your Mortgage Considered An Expense For Rental Property

Is Your Mortgage Considered An Expense For Rental Property

Is Your Mortgage Considered An Expense For Rental Property